Barbados Tax and Duty Free

Duties Charged on Select Imports

Most excisable goods are subject to the tax at a specific rate, with the exception of motor vehicles, which are subject to ad valorem rates (tax based on the value of the item). Very few items are exempt from excise taxes. These include motor vehicles imported by the diplomatic corps and other organisations exempt from customs duty under Part II-B of the Customs Tariff. Excise Tax is charged on four categories of goods: Motor Vehicles; Tobacco Products; Alcoholic Beverages and Petroleum Products.

Value Added Tax

Value Added Tax is charged at the rate of 17.5%. This tax is compounded and is charged on the total of the CIF Value and any other import taxes. Some goods are zero-rated.

Duties Charged on Select Imports

Generally, most items are subject rate of duty of 20%. Below are a few examples that are exceptions to this:

Product

Agriculture

Commercial and New Furniture

Clothing

Jewelry

Motor Cars

T-Shirts

Rate of Duty

40% 60% 60% 60% 45% 115%

Import License Required

Yes Yes

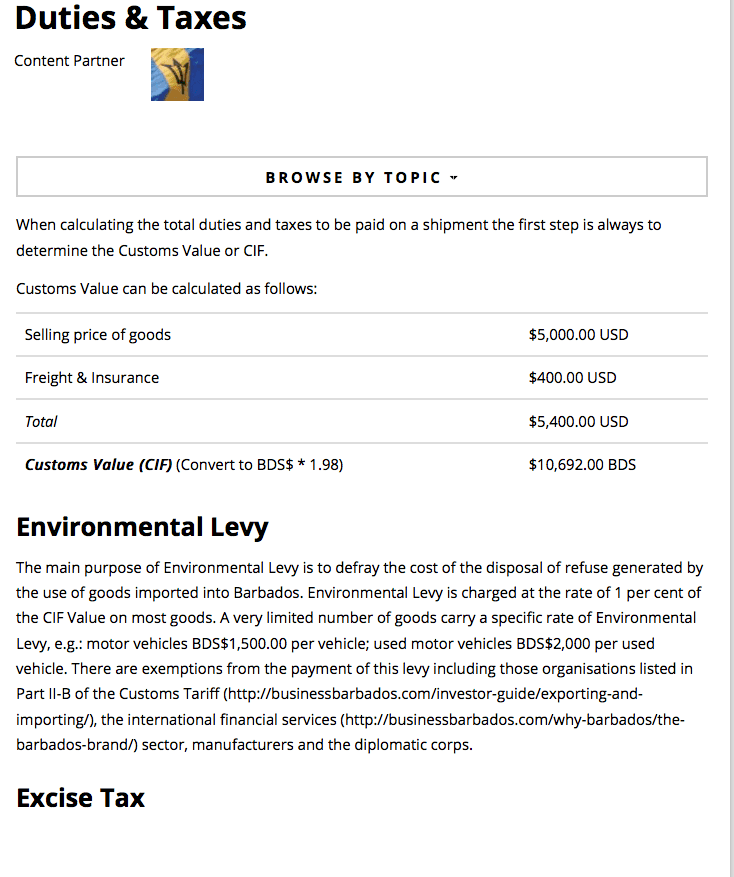

Calculation of Duties and Taxes

A Specific Example of the method of calculation of duties and taxes is provided below:

Customs Value

Import Duty: 20% of Customs Value ($100.00 * 20%)

Environmental Levy: 1% of Customs Value ($100.00 * 1%)

Value Added Tax: 17.5% of (Customs Value Plus Sum of Duties and Taxes) (($100.00 + $20.00 + $1.00)*17.5%)

$100.00 $20.00 $1.00 $21.18

Total Duties and Taxes: ($20.00 + $1.00 + $21.18) $42.18

Payment of Duties and Taxes

The Customs Department will release your goods after all import requirements have been met, including the payment of duties and taxes. Upon receiving your payment, the computer system will print a detailed statement on the copies of your Customs Declaration. You will receive copies of the Customs ( http://businessbarbados.com/investor-guide/exporting-and-importing/ ) declaration with the printed statement. One of the copies will serve as your receipt.

Uncertified cheques may be accepted subject to the following conditions:

-

Youmusthavetwopiecesofpersonalidentification,oneofwhichmustbeaphoto identification;

-

Nochequepreviouslyissuedbyyouhasbeenreturnedforinsufficientfunds;

-

Thepaymentyouaremakingisnotforapenalty;

-

ThechequeisfromarecognisedBarbadianfinancialinstitution;and

-

Thechequeisnotwrittenbyorpayabletoathirdparty.

There is presently an Account Holders Module in place that allows for Importers to take delivery of their goods and pay the duties and taxes within 10 days of assessment of the declaration. A Bond must be executed to provide security for the duty liability. The Customs ( http://businessbarbados.com/investor-guide/exporting-and-importing/ ) and Excise Department is in the process of migrating to a Prepayment System, which allows importers to deposit sums of money with the Department and to draw down on these deposits and replenish them as necessary. Importers may contact the Computer Division for further details. Importers who have rush shipments and wish to clear them outside of the official hours may do so, but would be required to pay fees and travelling costs for the extra attendance of Customs personnel. Additional fees are required where the extra attendance of personnel from other regulatory agencies is necessary.

Connect with us for more relevant Informations.

Quick Links

Follow Us

Additional Information

Delivery Services

Opening Hours

Other Services

Contact Us

Social

Trusted by:

Yhwh's Olive Branch

Charity